17 Of The Worst Financial Advice People Have Received - Some Of Them Are Downright Horrific

Some of them could even land you in jail.

Everyone lives their life differently and everyone comes from different backgrounds. So everyone's take on their finances will be different.

Despite that, there are some things that we all have to deal with no matter what like savings, taxes, and the like. That's why we still value financial advice given by other people.

When we say financial advice though, we mean the kind that is actually helpful and that actually helps us build the life we want for the present and the future. That's the kind of advice everybody is seeking out.

There are, however, some people out there who are giving out advice that can actually make life worse for others. Some of these pieces of advice can actually lead to more money loss while a few can actually end people up in jail.

To get to know what these tips are, Reddit user u/Miserable-Tea-1836 asked Redditors, "What's the worst piece of financial advice somebody has given you?" and the comment section was flooded with all these responses that are just bewildering.

Sure, they might have worked for the person who gave the advice but again, we have different life circumstances. And just because it worked doesn't mean it's necessarily right.

Anyway, here are some of the best responses:

1. If you don't pay your phone bills, there will be way bigger consquences

Your phone bill can end up in collections which in turn will hurt your credit scores. And if your credit scores are bad then you might have difficulty doing things like renting an apartment or opening utility accounts.

kor_hookmaster

kor_hookmaster2. Just because you cut them up or burn them up doesn't mean that your balance suddenly magically doesn't exist

Again, this will just hurt your credit scores.

SalemScout

SalemScout3. The 401k exists for a very good reason and you should take advantage of it

If your job offers a 401(k) benefit, it's a good idea to contribute. Why?

First, the money you put in will lower your taxable income which can lead to a bigger refund come tax day. Second, if your employer offers to match your contribution, you're basically getting free money.

TheRealOcsiban

TheRealOcsiban4. Unless you're the luckiest guy in the world, this isn't the best way to increase your money

Generally, casino games are made to be in favor of the house. You can win but you'll probably lose a lot more before that happens.

differentiatedpans

differentiatedpans5. This isn't necessarily true

If you're in the US, this is not a good tip. That's because of the country's "progressive" tax system.

With that system, the higher tax rate will only apply to the amount of your income that's above your old tax bracket if you move up a position into the next tax bracket.

champagne_of_beers

champagne_of_beers6. A degree doesn't always necessarily mean easy money

Going to school is definitely worth it but when it comes to paying back those heavy student loans, it will depend on your career and goals. Instead, don't rely solely on loans.

Talk to your school's financial aid office, apply for scholarships, and think of other ways to reduce the costs of schooling.

Dethstrok9

Dethstrok97. Savings accounts are always great to have

Having some money stashed away for a rainy day helps give yourself some cushion when a surprise emergency pops up.

unidentifedjojo

unidentifedjojo8. This just destroys both your future and the kid's future

While it's true that you can never actually be fully prepared for a kid, there are so many things you can do. This includes saving up for their essentials, their college fund, and for emergencies.

watashinomori

watashinomori9. This is just taking away your basic right

Negotiating should always be on top of your list. This is so you're not low-balled.

However, you have to be prepared to go into the negotiation knowing your numbers so check sites like Glassdoor to have an idea of the average salaries for people in your role.

summertimecinnamon

summertimecinnamon10. You're not going to be able to run from them forever

If you keep skipping out on bills, you're just inviting collector calls and letters for the foreseeable future. That's why it's always great to look at options like payment plans or extensions that are available.

chesterlola2014

chesterlola201411. Just because they're an option doesn't mean they're a great option

They may seem nice at first but they often come with heavy fees and no grace period so you'll be paying sky-high interest rates in no time. They're only good to use as a last resort for emergencies.

PrincipleHairy931

PrincipleHairy93112. You could actually end up paying more than the things are worth

Renting furniture might look cheaper up front but between all the additional fees, they often add up to a more expensive price than the cost of the item.

Tbables

Tbables13. When it comes to these kinds of purchases, you should never ever rush into them

New cars drop in value the minute you drive off with them that's why used cars are often better deals.

rleash

rleash14. There are so many wrong things about this statement

If there's extra left in your bank account, that doesn't mean you have to burn it all off. Sure, you can treat yourself but you can also invest some of it and put it to work.

plzeatslugsmalfoy

plzeatslugsmalfoy15. This will just build up the amount you have to pay

Living on credit cards without a good source of income will lead you into a debt spiral and tank your credit scores.

Prannke

Prannke

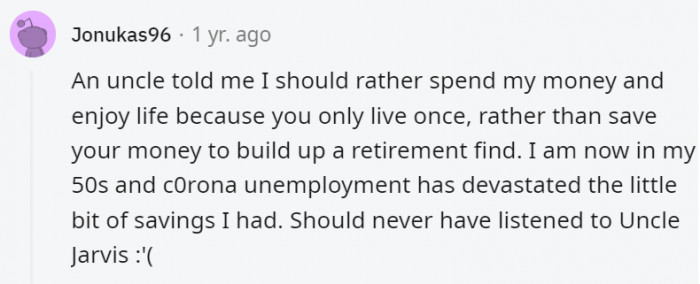

16. That bit of you only live once includes your retirement years okay

Retirement may always seem far away but saving early makes a big difference for it.

Jonukas96

Jonukas96

17. Or at least make sure to teach the person you're leaving it to to be financially responsible

There are pros out there for a reason and they can pretty much teach you how to do things you've never been taught before.

whoisniko

whoisniko

Money is a fickle thing. One day you can have it and one day, you can have none.

That's why learning how to be responsible with it is so important. And part of learning to be that way is knowing which advice to take and which not to.

Many people will have different things to say but they're not the ones who are going to be living the consequences of their advice to your life.

Liezel